maryland digital ad tax effective date

A constitutional challenge to Marylands digital ad tax by Comcast and Verizon will advance after a state court judge largely denied the states motion to dismiss the case. At least seven points however bear making.

/ScreenShot2021-02-11at1.37.43PM-974cede3b55f40428918bba4eb8d695b.png)

Form 6251 Alternative Minimum Tax Individuals Definition

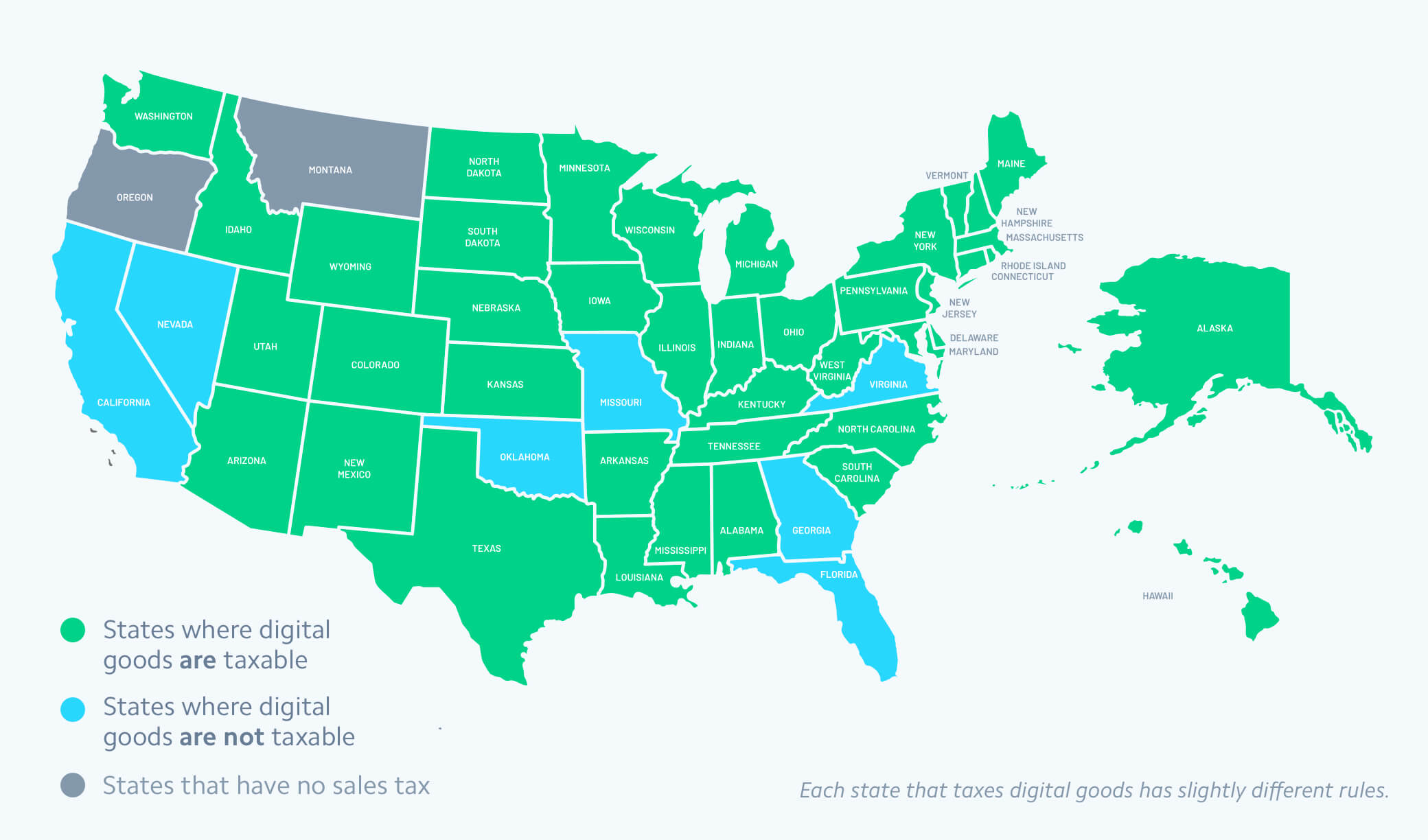

Effective March 14 2021 the Maryland sales and use tax applies to the sale or use of a digital product or a digital code.

. Earlier this year Maryland legislators overrode Governor Larry Hogans R veto of HB732 approving a digital advertising tax the first of its kind in the country. The tax rate varies from 25 to 10 depending on a companys global annual gross revenues. Persons with global annual gross revenues equal to or greater than 100000000 must pay a tax on the portion of those revenues derived from digital advertising services in.

The statutory references contained in this publication are not. The second bill HB. The effective date subsequently was delayed from 2021 until 2022.

732 establishes a new digital advertising gross revenue tax the first in any state. A bill that would amend the Maryland Digital Advertising. Even though the legislation says the tax is effective July 1 2020 under the Maryland Constitution vetoed legislation becomes effective the later of the.

787 which delays and modifies the Digital Advertising Gross Revenues Taxa tax of up to 10 on the gross. 732 establishes a new digital advertising gross revenue tax the first in any state. But legislators punted several crucial questions to the state comptroller who last week submitted proposed regulations for the digital advertising tax to the state Joint Committee on Administrative.

The effective date subsequently was delayed from 2021 until. The state Senate Monday overwhelmingly passed SB. The tax rate is not determined with respect to Maryland.

This amendment would not delay the effective date of the tax it only changes the applicable tax year 2021 to 2022. 732 2020 the Maryland Senate on February 12 2021 passed the nations first state tax on the digital. Most notably Senate Bill 787.

Much of the tax will be borne by in-state companies and individuals. Wednesday March 17 2021. The potential pitfalls of Marylands proposed digital advertising tax are numerous and the novelty of the proposal means that tax policy experts are still grappling with its implications.

The tax will apply to any company that meet two thresholds 1000000 of gross revenues in Maryland derived from digital advertising services and 100000000 of global annual gross revenues. On April 12 2021 Maryland legislators passed Senate Bill 787 which proposed several significant amendments to Marylands digital ad tax. Overriding the governors veto of HB.

The second bill HB. The first estimated quarterly payment at least 25 of the reasonably estimated tax based on 2021 Maryland digital ad tax revenues is due to the Comptroller by April 15 th.

Introduction To Us Sales Tax And Economic Nexus

View All Hr Employment Solutions Blogs Workforce Wise Blog

Define Reasonable Can Maryland S New E Book Law Help Change The Marketplace

States With The Lowest Corporate Income Tax Rates Infographic Infographic History Geography Best Places To Move

View All Hr Employment Solutions Blogs Workforce Wise Blog

Corporate Secretary Certificate Template 2 Templates Example Templates Example Certificate Templates Free Certificate Templates Templates

Wedding Photography Contract Template Wedding Photography Contract Template Wedding Photography Contract Photography Contract

How To Charge Sales Tax In The Us 2022

How To Charge Sales Tax In The Us 2022

Pin On Know How Business Trends Tips Of The Creative Economy Aka Creative Industries

State Legislation Map Densebreast Info Inc

Registration Statement On Form S 1

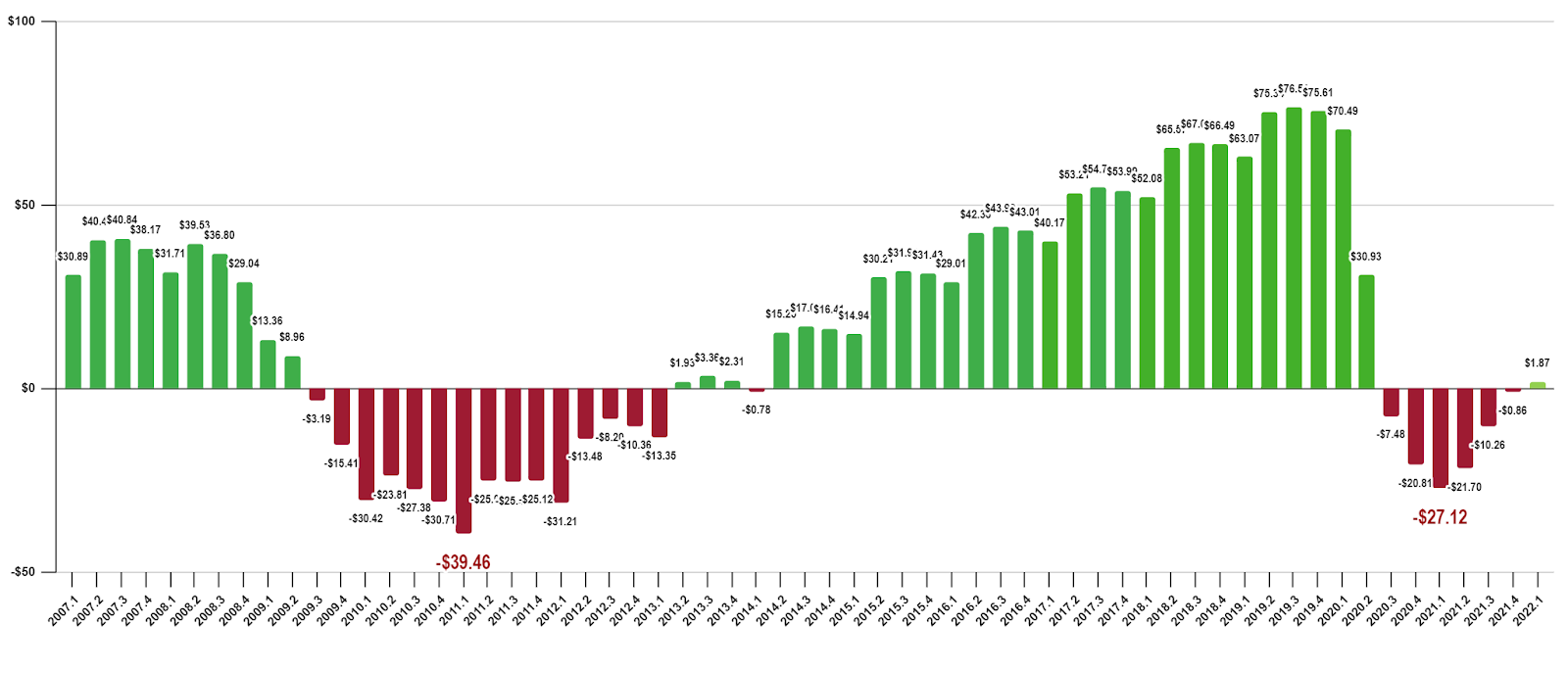

Recent State Tax Changes Taking Effect Tax Foundation

Registration Statement On Form S 1

Maryland Enacts Digital Products Sales Tax Exclusions Pwc

Jennifer Spang National Tax Partner Pwc Linkedin

New Tax For Digital Payments No But Big Changes May Be Coming Findlaw